VND

20.83

billion

Business and production operation

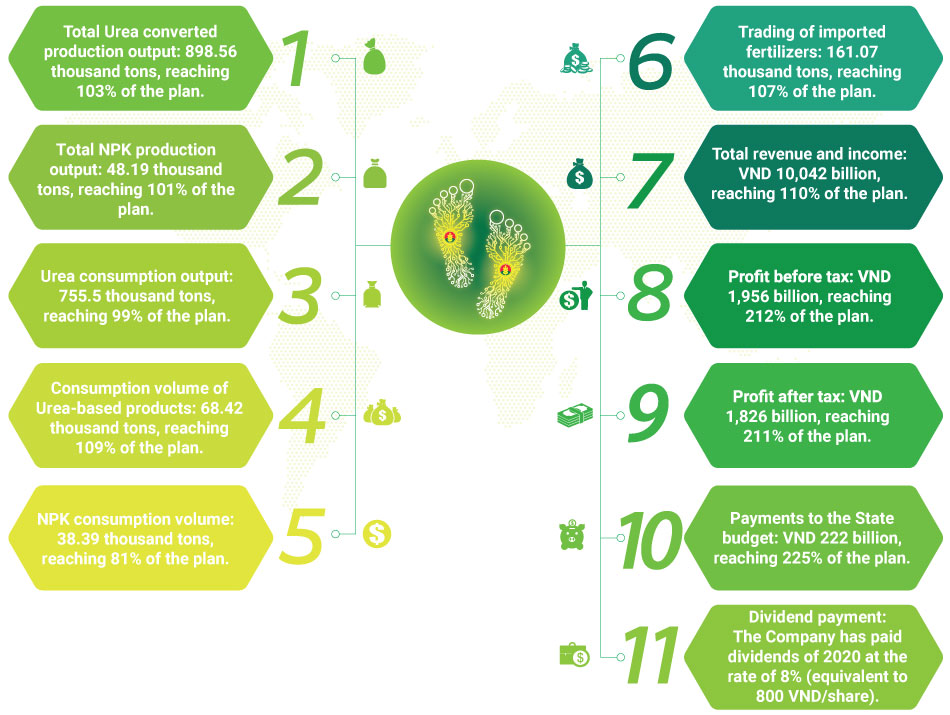

In 2021, besides the advantages thanks to highly increased selling price, PVCFC faced many difficulties due to the Covid-19 pandemic complicated developments and the sharp increase in oil prices. However, with the efforts in implementing solutions for energy/material optimization and cost savings/reduction, maintaining safe and stable plant operation and being flexible in sales, PVCFC has exceeded almost production and business plan in 2021, to be specific (according to PVCFC’s audited consolidated financial statements):

Note: Targets for 2021 were implemented according to PVCFC’s Disclosure No.2064/PVCFC-IR dated 27 December 2021. These targets were adjusted to replace the production and business targets approved in the Resolution No.854/NQ-PVCFC dated 27 April 2021 of Annual General Meeting of Shareholders 2021.

Investment project to produce complex fertilizers from molten Urea with a capacity of 300,000 tons/year was behind schedule. From 01 December 2021, copyright provider has cooperated with General Contractor and PVCFC to inspect entire production line and conducted a trial run of NPK products with formula 20-20-15, 16-16-8, etc.

In addition, PVCFC also implemented some projects such as raw CO2 conversion and supply, Long An raw material warehouse, research and development center, etc.

Total value of investment and equipment procurement in 2021 was VND 72.58 billion, reaching 75% of the plan.

In 2021, PVCFC has developed and issued regulations on functions, tasks, authority and organizational structure of functional divisions/departments; Continue to update and complete the Regulations and Operational Procedures according to the new model in line with the Company’s strategic goals.

In the third quarter of 2021, the Company’s Board of Directors established the Audit and Risk Management Committee, and the Governance, Human Resources and Compensation Committee to perfect the governance model following good practices, ensuring that the Company’s activities can be operated effectively, complying with legal regulations, the Company’s Charter, internal regulations and processes.

Governance is always the top focus of PVCFC’s Leadership, pioneering in applying advanced management system tools, implementing digital technology transformation, building corporate culture, etc. Details are as follows:

As of 31 December 2021, PVCFC has only invested in one (01) subsidiary - PetroVietnam Packaging Joint Stock Company (PPC), with contributed capital of VND 20.83 billion, accounting for 51.03% of charter capital. In 2021, PPC has completed its production and business targets, in which profit after tax in 2021 is VND 5.8 billion, reaching 102.2% of the target, and ROE reaches 12.08%.

PetroVietnam Packaging Joint Stock Company (PPC)

VND

billion

The Company’s internal control system was established right from the early years of the Company’s establishment to focus on the inspection and control of compliance, operations, finance, and risks.

The Company has completed the management model in 3 lines. The internal processes and risk management system are built according to COSO standards. The Board of Directors also pays great attention to internal audit; therefore, a consultant firm is hired to review the internal audit process and regulations, build a 3-year internal audit plan and an assurance map to help the 3 management lines operate effectively.

Currently, the Company’s internal control, internal audit and risk management systems are operating well and effectively. The top risks are soon identified and solutions are provided in a timely manner.

Financial statement appraisal

The Supervisory Board has appraised the quarterly, semi-annual and annual financial statements in 2021 to ensure their correctness and transparency. The appraisal results are as follows:

PricewaterhouseCooper (PwC) Vietnam Co., Ltd. was selected to audit PVCFC’s financial statements in 2021. PwC has reviewed and audited the semi-annual and annual financial statements in a cautious, independent and objective manner. The audit firm has complied with professional ethics and standards during the audit. The audit results of the financial statements have fully, truly and reasonably reflected the financial position as well as the business performance of the Company.

In order to ensure that the production and business activities at PVCFC follow the plan in 2022 to be highly effective, the Supervisory Board recommends a number of contents as follows:

In 2022, the Supervisory Board properly implements the rights and responsibilities as prescribed in the Enterprise Law, the Company’s Charter and the tasks in 2022 set out by the General Meeting of Shareholders. The Supervisory Board will focus on inspecting and monitoring the following main contents:

On the basis of reviewing and evaluating the capacity of independent audit firms, the Supervisory Board of PetroVietnam Camau Fertilizer Joint Stock Company would like to submit to the Board of Directors authorized by the General Meeting of Shareholders to select one of the following audit firms, including Deloitte Vietnam Co., Ltd., KPMG (Vietnam) Co., Ltd., Ernst & Young Vietnam Co., Ltd., PwC (Vietnam) Co., Ltd. to audit the Company’s financial statements in 2022.