BÁO CÁO PHÁT TRIỂN BỀN VỮNG 2023

Detailed information about PVCFC’s compliance with ACGS2023 is always updated here: readmore

Comprehensive

information on the operational efficiency of PVCFC’s Board of Directors is fully described in Chapter 4 of

the 2023

Annual Report. In this section, we report on how PVCFC ensure the effectiveness of the Board of

Directors.

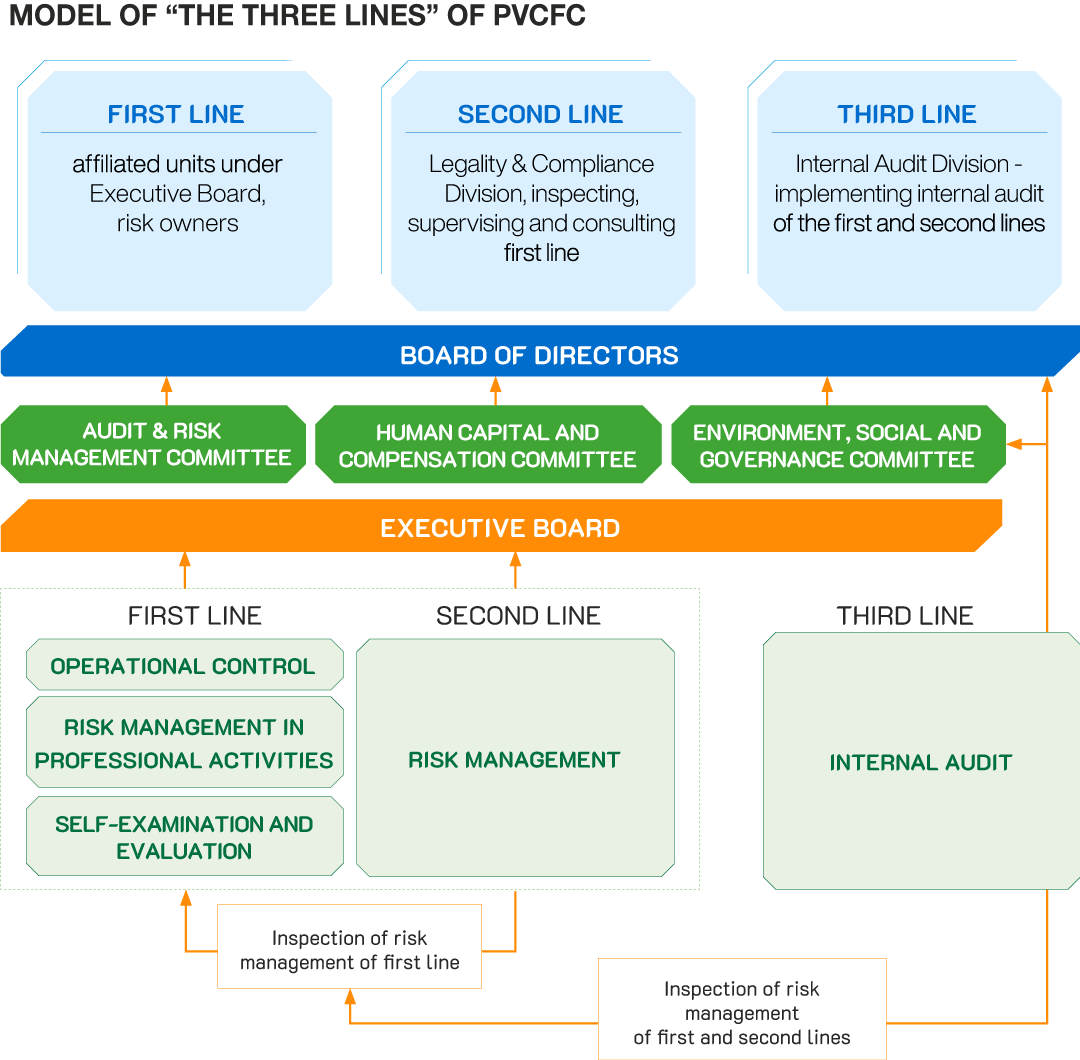

The Company currently has three Committees under the Board of Directors: (i) the Audit and Risk Management Committee (ARMC); (ii) the Human Capital and Compensation Committee (HCCC); and the Environmental, Social, and Governance Committee (ESG Committee).

The members of these Committees are all non-executive Board members, and the Chair of the ARMC is independent Board member Do Thi Hoa, while the Chair of the HCCC is independent Board member Truong Hong.

The structure and composition of these Committees are appropriate for the Company’s actual conditions. The activities of these Committees help the Board of Directors leverage collective strength, enhance their role, and improve the Company’s governance efficiency.

The Audit and Risk Management Committee (ARMC) is a specialized unit under

the Board of Directors, with the function of advising and consulting the Board on the Company’s

audit and risk management areas.

The ARMC reports directly in writing to the Board of Directors and

operates independently in performing its duties to ensure that the Company complies with all

legal regulations.

The ARMC reviews and approves the Company’s quarterly, semi-annual, and

annual financial statements; reviews the Company’s internal control and risk management systems;

reviews transactions with related parties under the Board of Directors’ or General Meeting of

Shareholders’ approval authority and makes recommendations on transactions requiring approval

from the Board of Directors or the General Meeting of Shareholders; and oversees the Company’s

Internal Audit Department.

Additionally, it performs other duties as stipulated in the ARMC’s operational regulations (refer to: https://www.pvcfc.com.vn/quan-he-dau-tu/dieu-le-quy-che-bieu-mau)

The Human Capital and Compensation Committee (HCCC) is a specialized unit

under the Board of Directors, responsible for advising and consulting the Board on matters

related to organization, personnel, compensation, and the company’s policies.

The Committee

reports directly in writing to the

Board of Directors and operates independently to ensure that the Company complies with all legal

regulations.

The ESG Committee is a specialized unit under the Board of Directors, with

the functions of advising, consulting, and overseeing areas related to sustainable development

and corporate governance for the Board.

The Committee reports directly in writing to the Board of Directors and operates independently to ensure that the Company complies with all legal regulations.

The Internal Audit Department, under the Board of Directors, performs

internal audit tasks as prescribed and reports directly to the Audit and Risk Management

Committee (ARMC).

In May 2024, the Board of Directors established the Office of the Board of Directors, under the Board, to assist with corporate governance and manage relations with stakeholders, including relationships with shareholders and investors. The Chief of the Office of the Board of Directors also serves as the Corporate Governance Officer, responsible for ensuring that corporate governance is practiced according to best practices and in compliance with legal regulations.

PVCFC’s Board of Directors recognizes the importance of diversity among its members

and ensures the best practices in this regard. The Company’s internal governance regulations provide

direction and policies to ensure diversity within the Board in terms of gender, age, and professional

skills that align with the Company’s long-term strategy.

In recent years, based on the Company’s strategy, the Company has aimed to add one female Board member and one Board member with experience in agriculture and soil health. We achieved this goal in 2021. The Company aims to achieve the following diversity goals for the Board of Directors by 2030:

(For details, please refer to the 2023 Annual Reportpages 54-57) Annual report 2023 page 54-57)

The Company applies the “Three Lines governance model” to assist the Board of Directors and the Executive Management in not only effectively controlling risks but also creating greater value by identifying factors that could affect the Company’s mission, vision, and strategic objectives, and by implementing measures to mitigate potential risks and capitalize on opportunities. The Board of Directors has established an internal control system model based on the value chain and risk management system governance from the Company level to the unit level.

Since the implementation of risk management, the Company has issued a Risk

Appetite Statement, Risk Tolerance Levels, and Risk Metrics; developed regulations for risk management

activities, and established both Company-level and unit-level Risk Registers.

Based on practical operations over the years, the legal framework for risk

management is continuously reviewed and updated by the Company to align with its strategic objectives

during each period.

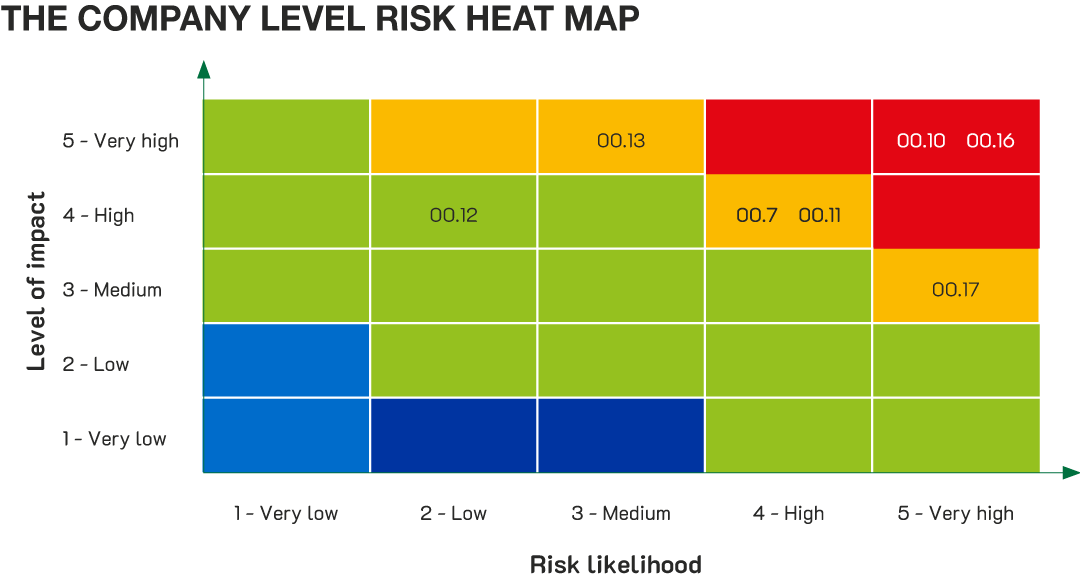

The Company has categorized risks into four main groups: strategic risks,

operational risks, compliance risks, and financial risks. The Company has issued a statement on risk

appetite and risk tolerance levels and developed risk metrics to classify and identify key risks on

the Risk Heat Map. For information technology risks, the Company has identified them as part of the

Company-level risks that need to be controlled and has also created a specific criterion in the

Company’s risk metrics related to information technology.

These risks are evaluated and propritised based on the likelihood of occurrence and the impact level on the Company-level Risk Heat Map

In response to the essential needs of sustainable development trends for all

businesses, PVCFC is increasingly focused on governance based on the three factors: Environment,

Social, and Governance (ESG).

Building on the early-established risk management system, PVCFC conducts regular annual reviews and reassessments of key risks. In practicing ESG, PVCFC categorizes its risk portfolio according to the three E-S-G factors, ensuring that operations are conducted safely and in compliance with state regulations on emissions, waste, QHSE standards, and other relevant standards. Consequently, risks related to safety, health, and environmental violations are tightly controlled, preventing incidents or violations that exceed allowable limits.

Internal Audit Department: Established in November 2020, the Internal Audit

Department is under the Board of Directors and conducts internal audits across the entire Company in

accordance with Decree 05/2019/NĐ-CP. The Internal Audit Department consists of 5 members with

expertise in various fields: Law, Finance, Auditing, Accounting, and Technology.

The Head of the Internal Audit Department is Mr. Vu Chi Duong, who holds a Master’s degree in Finance and Banking, a Bachelor’s degree in Auditing and Accounting, and a Bachelor’s degree in Law. Mr. Vu Chi Duong has extensive experience in the fields of legal affairs, finance and accounting, internal control, risk management, and auditing.

The Company strictly complies with legal regulations on environmental protection,

pollution control regarding waste and emissions, resource conservation, and actively engages in in-depth

learning about current environmental management regulations, ensuring management according to the ISO

14001:2015 standard. In 2023, the Company did not experience any instances of non-compliance with legal

regulations.

The Company has issued policies on quality, safety, and the environment; established

regulations and guidelines for implementation; and conducted inspections and testing to control the

environment in production areas and other locations where the Company operates. These policies,

regulations, and procedures are widely communicated to all employees to raise awareness and responsibility

towards the community and the living environment.

The Company collaborates and coordinates with businesses and organizations with

experience in assessing and improving environmental conditions within the enterprise.

All emission sources from the Plant are tightly controlled and minimized in

quantity, with quality always meeting the regulated limits before being released into the environment.

In 2023, the Ca Mau Fertilizer Plant consistently maintained strict control,

ensuring that no serious environmental incidents occurred at the Plant. PVCFC fully complies with the

requirements, policies, and regulations of the Environmental Protection Law, and contributes to

environmental protection funds, demonstrating its commitment to environmental responsibility and the

community as a sustainable enterprise.

To implement the strategy set forth by the Board of Directors (BOD), Ca Mau

Petroleum Fertilizer Joint Stock Company (PVCFC) has undertaken various digital transformation activities

aimed at optimizing production processes, enhancing business efficiency, and improving service quality.

These activities include the adoption of modern technologies in operational management, automation of

production processes, and the development of digital solutions to strengthen governance and

decision-making capabilities.

(Details can be found in the Annual Report, Annual Report 2023 Page 225)